How planetary boundaries impact sovereign bonds and equities

November 11, 2019: 12:00 pm – 1:00 pm In Person

- This event has passed.

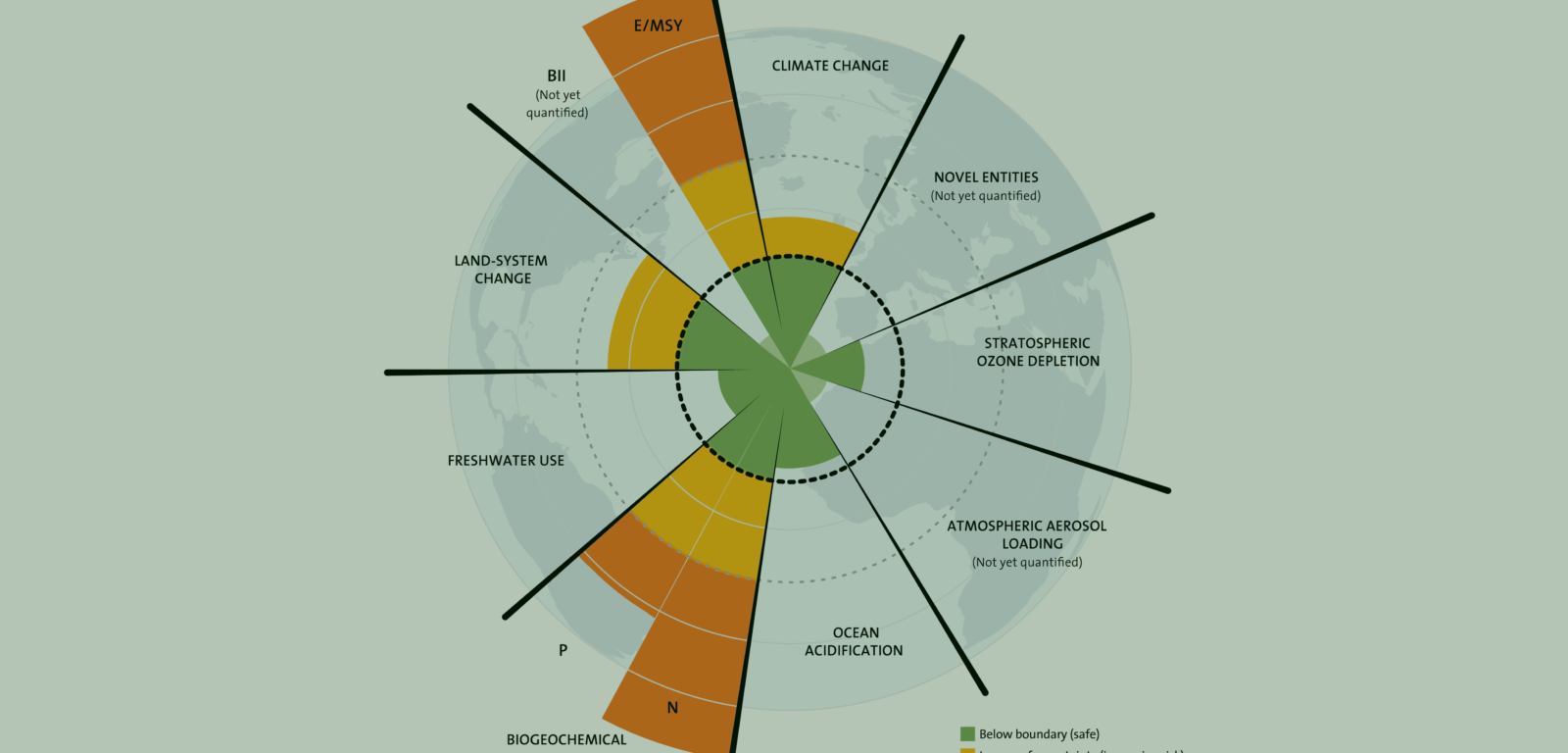

How can we align capital markets with a sustainable future and planetary boundaries? This member-organized event will feature the Planet Tracker, a financial thinktank located in London, whose goal is to embed the true value of nature into global financial flows. Planet Tracker supports investors, analysts, and other stakeholders in mainstreaming sustainability into capital markets, with a focus on sovereign bonds, aquaculture, wild-catch fisheries, agri funds, and other topics.

Fisheries:

As highlighted in Forbes, the commodity markets are exposed to the risks from a variety of factors – and we will focus on how unsustainable practices undermine the stability of global investment portfolios. The Fish Tracker report Perfect Storm: Profits at Risk in the Japanese Seafood Industry investigates the impact that financial institutions have on the global seafood trade, and japan in particular. Japanese seafood production decline – caused falling global fish stocks, increased competition and climate change – poses financial risks not just to seafood companies, but also to global investors who own $134 billion in Japanese equities.

Sovereign Bonds Impact:

How can we measure the connection between agriculture production and climate impacts, as felt in the flood and drought intensity? Planet Tracker will present the case of Argentina and Brazil.

Speakers:

Jeff Gibson, Sr.

Climate Finance Consultant, World Bank Group

Olha Krushelnytska, CFA

Green Finance Specialist, World Bank Group

Gabriel Thoumi, CFA, FRM

Director of Financial Markets, Planet Tracker